Disclosures

Search the current disclosures for any issuer name or ticker covered by Barclays Research or any independent research firm whose reports are made available by Barclays.

| Issuer: | E.ON (EONGn.DE) | |

| Coverage Analysts: |

Peter Crampton - Primary Analyst | |

| Current Stock Rating/Industry View: | Equal Weight/Positive |

Disclosures applicable to this issuer:

Important Research Disclosures:

Valuation Methodology: We base our price target on a sum-of-the-parts valuation. Our DCF valuations of the key divisions use projected 2025-30E free cash flows, taking into account a terminal value based on normalised cash flows. Our forecasts reflect the updated near-term 2025E and the medium-term (2024-28E) financial guidance provided at the FY25 results on 26 February 2025. Our forecasts reflect E.ON's historic net synergy target of €780m coming from the Innogy transaction.

Risks which May Impede the Achievement of the Barclays Research Price Target: Based on its significant focus on regulated distribution networks the related regulation represents a major risk factor for the group. It is, however, important to remember that no major regulatory updates are due in the near term. Any inability to compete successfully in E.ON's markets may harm its business. This could be a result of many factors which may include geographic mix and the introduction of improved products or services from competitors. E.ON's operations may be materially affected by global economic conditions including conditions in the financial markets. The company is exposed to market risks, such as changes in interest rates, foreign exchange rates and input prices.

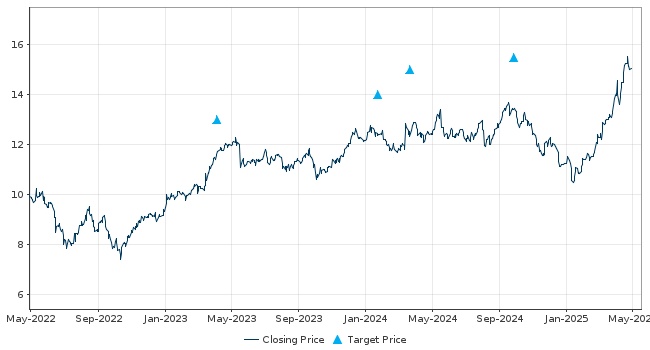

Price Chart:

Source: IDC, Barclays Research

E.ON

Currency=EUR

Below is the list of companies that constitute the "industry coverage universe":